Administration fee rip off?

It is common these days to get your insurance quote and gasp at the administration fees on insurance policies. How can an insurer justify charging you for the premium and then add the admin fees on top? Isn’t this taking the biscuit?

The surprising answer is that they are actually saving you money.

Don’t believe me? Read on.

Insurance Premium Tax was introduced by the government in 1994 at a rate of 2.5%. Since then, it has been used as a stealth tax revenue raiser, being increased to 4%, 5%, 6%, 9.5%, 10% and from June 2017 will be at 12% following three rises in 18 months. It is expected to raise £4.6 Billion in the current financial year.

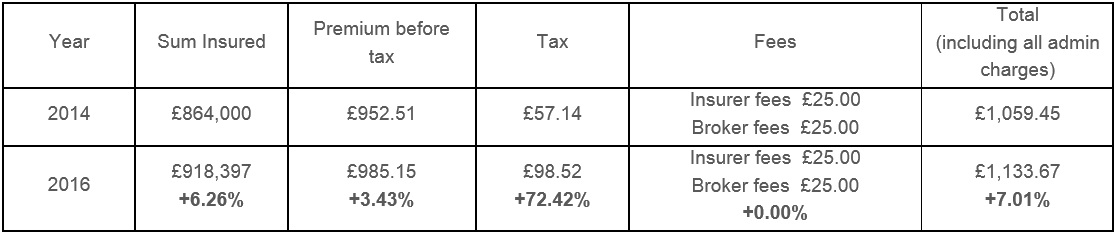

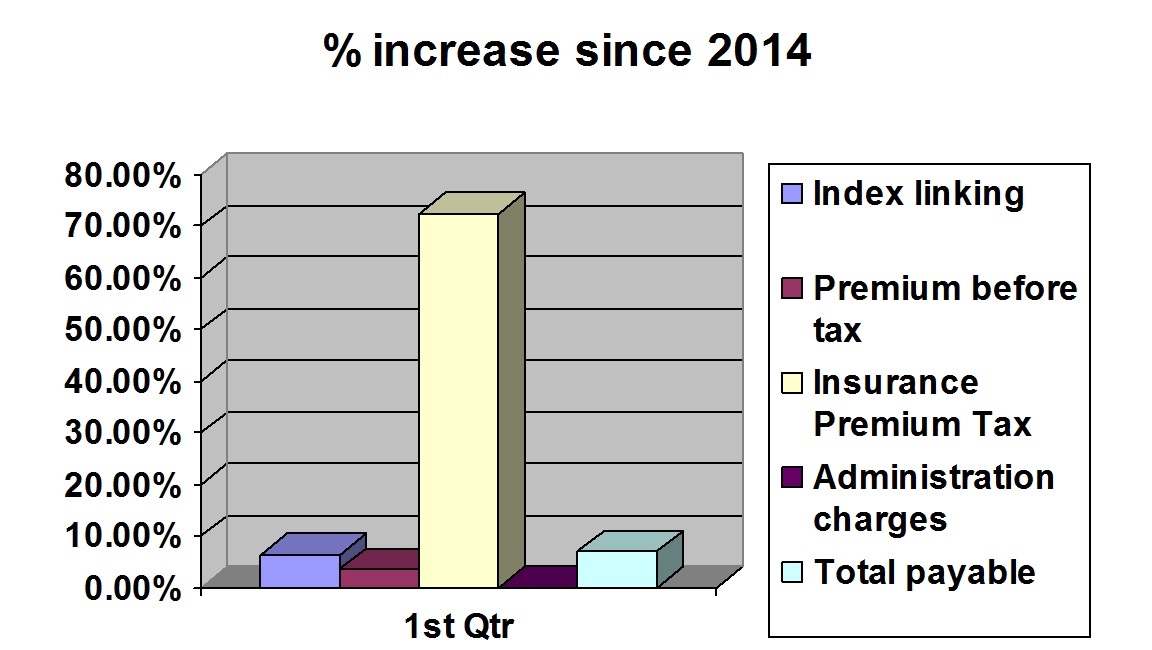

I had a look at the premium history on one particular buildings insurance policy and the figures were surprising.

Reference to ABI Average household premium figures shows a similar pattern developing, with average premiums (before tax) decreasing slightly, over the same period* that IPT is increased hugely. With the standard rate of Insurance Premium tax charged to the customer increasing by 66% in the past 2 years and a further increase announced in the November Statement, it’s incredible the government criticises insurance companies for increases in premiums which are the product of government policy itself.

The cost of policy administration has historically been included in the premium. However, once IPT started to increase, it made sense to separate the cost of administrating the policy and specify it individually, taking it out of the taxable part of the premium.

As the Insurance Premium Tax charges are limited to the basic premium, administration fees are not subject to this tax and therefore unaffected by increases in IPT. So although the fees may seem excessive at first glance, they are actually saving you money, by removing some of the total amount payable from the burden of taxation.

Ultimately, an insurer will need to collect a certain amount of money to provide you with the cover you need, so you’ll pay it, one way or the other. This way, the government’s scoop is just a little bit less.

So next time you see an insurer’s administration charge on your renewal invoice, bear in mind, this is actually reducing your total spend, rather than increasing it.