If you need property insurance following a large claim, you will need a highly skilled insurance broker and a willingness to look at risk management. After a serious fire, flooding, storm damage, escape of water or injury claim, insurers need a very good reason to risk taking on your business.

One of the most frustrating things I have to deal with as an insurance broker is persuading underwriters of the merits of an insurance risk after there has been a major claim in the past year or two. Unfortunately, once a large claim has been paid out, the chances of getting an alternative quotation on the next renewal date plummet. So why is this?

The easiest way to explain is by looking at motor insurance. If a car owner has had 5 fault accidents in the last 3 years, you could deduce that they are a not a brilliant driver and the chances of them having a further accident are high. Therefore an insurer is likely to quote them a high price for a policy.

Even when a driver has a string of incidents he could do nothing about – collision whilst parked, malicious damage to vehicle, hit in the rear by third party etc, you can still appreciate an insurer’s justification for loading their premium. Yes, there are random events that nobody can foresee or prevent, but you can certainly influence the probability of these things happening by the way you drive, where you park, how you look after your car, if fact your whole attitude to your vehicle and other road users will have an impact on the number of times you suffer these ‘random’ events.

Many underwriters have a similar attitude when looking at risk in other areas of insurance. Some of them make perfect sense, for example an office policy with numerous claims for accidents to office equipment, theft, water damage, suggests a firm with a casual attitude to risk management and therefore the probability of a serious claim, eg. an injury to a member of staff or the public is increased.

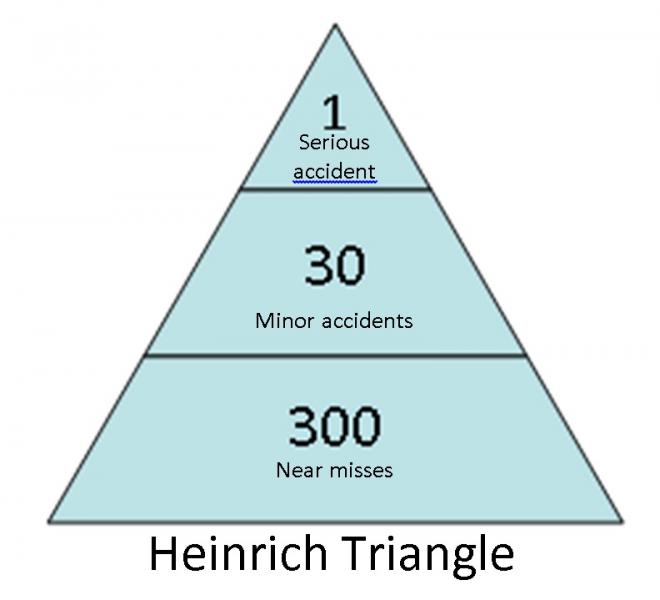

This is illustrated by Heinrich’s triangle, which was produced to illustrate that the risk of serious accidents occurring in the workplace is proportionate to the number of minor incidents to varying degrees according to the industry and how business is managed. The more often minor incidents are allowed to occur, the greater the chance of a serious one. The Heinrich triangle was not intended for use right across the risk industry, but it does serve to illustrate a very similar point.

So where does this leave us with regard to property insurance?

An insurance underwriter’s job it to identify the cases where a claim is more likely to occur and adjust their premium, terms or even their willingness to provide a quote accordingly. If a risk is presented to them with a £50,000 fire claim, their first reaction is (quite understandably) to question whether they should even be considering taking on a risk with such a poor claims record. The one serious claim represents an occurrence at the top of the Heinrich triangle. Does this mean the laws of probability point to numerous minor incidents on the horizon?

The insurance broker’s job is to present the facts to the underwriter in order to give him the confidence that he is not required to stick his neck on the line, as the claim which has occurred was an isolated incident and the cause has been dealt with effectively, which should prevent a recurrence. Of course, we can’t guarantee that nothing will happen, but as long as we can assure the underwriter that this risk can be viewed in the same (or sometimes even better) light as a claim free proposal, we are more likely to obtain a quotation. In order to do this, we need to look carefully at the risk proposed and assess what vulnerabilities contributed towards the previous loss and how those vulnerabilities have been addressed, safeguarding the property as far as possible in the future. This is why a proposer might be asked to fit a fire alarm or new wiring after a fire damage claim, new security or an intruder alarm following a burglary, or safety assessments and improvements in the event of an injury.